3 Simple Techniques For Estate Planning Attorney

3 Simple Techniques For Estate Planning Attorney

Blog Article

Estate Planning Attorney - The Facts

Table of ContentsThe 9-Second Trick For Estate Planning Attorney10 Easy Facts About Estate Planning Attorney ExplainedExcitement About Estate Planning AttorneyNot known Incorrect Statements About Estate Planning Attorney

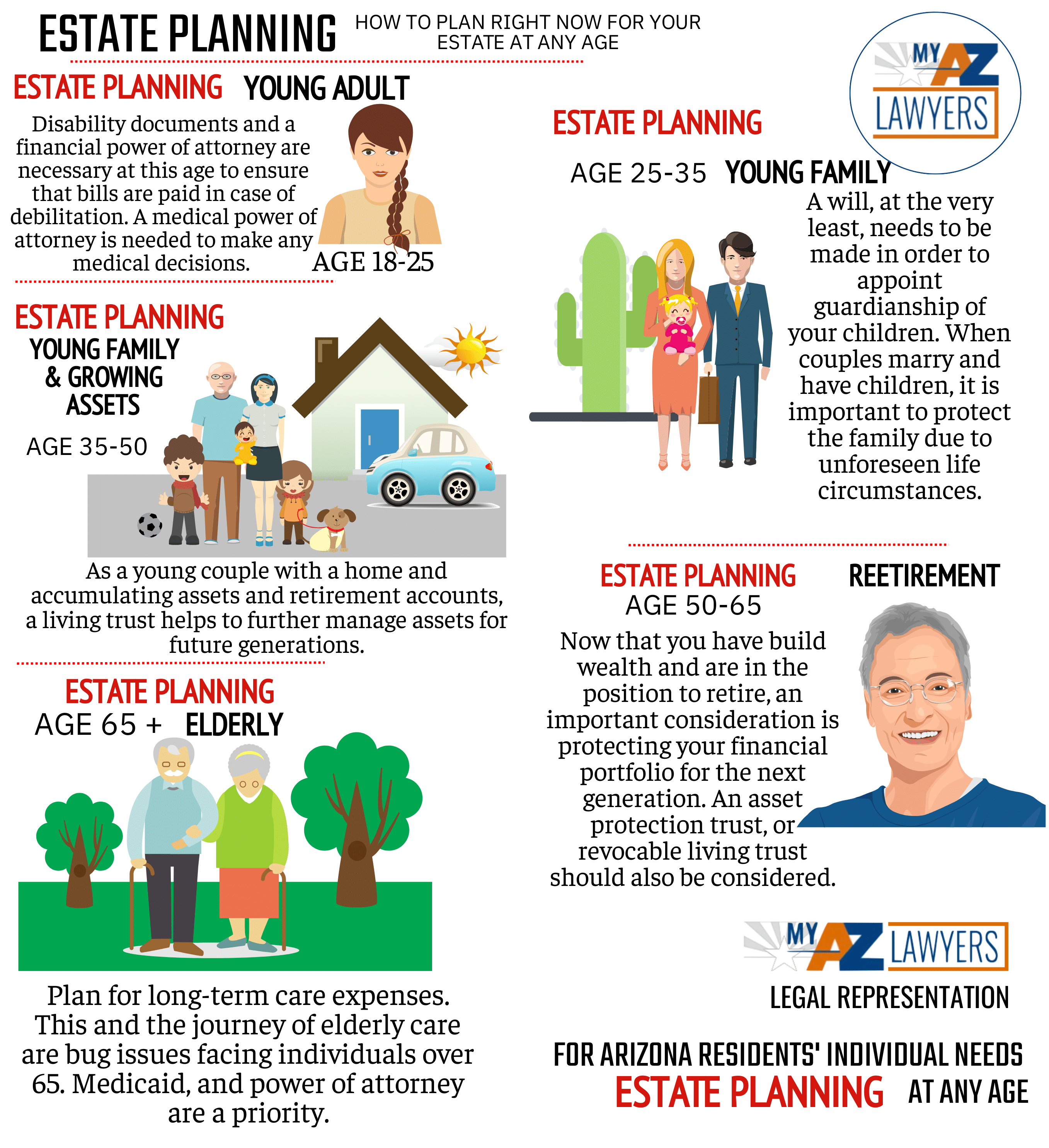

Estate planning is an activity plan you can make use of to determine what happens to your possessions and commitments while you're alive and after you die. A will, on the various other hand, is a lawful paper that outlines exactly how possessions are dispersed, that takes care of kids and pets, and any kind of other wishes after you die.

The executor additionally has to repay any tax obligations and debt owed by the deceased from the estate. Lenders typically have a minimal amount of time from the day they were alerted of the testator's death to make cases versus the estate for cash owed to them. Claims that are denied by the executor can be brought to justice where a probate court will have the last word regarding whether or not the insurance claim stands.

Get This Report about Estate Planning Attorney

After the stock of the estate has actually been taken, the worth of properties computed, and tax obligations and debt paid off, the executor will then seek permission from the court to disperse whatever is left of the estate to the recipients. Any type of estate tax obligations that are pending will certainly come due within nine months of the day of fatality.

Each specific places their properties in the trust and names somebody besides their partner as the recipient. Nonetheless, A-B trusts have ended up being much less preferred as the estate tax obligation exception functions well for the majority of estates. Grandparents might move properties to an entity, such as a 529 strategy, to sustain grandchildrens' education and learning.

The Of Estate Planning Attorney

This technique involves cold the value of a possession at its worth on the date of transfer. As necessary, the amount of possible funding gain at fatality is also iced up, allowing the estate planner click this site to approximate you can try this out their potential tax obligation responsibility upon death and far better prepare for the payment of revenue taxes.

If adequate insurance earnings are readily available and the plans are effectively structured, any type of revenue tax on the considered personalities of assets complying with the fatality of an individual can be paid without turning to the sale of possessions. Profits from life insurance policy that are gotten by the beneficiaries upon the fatality of the guaranteed are generally earnings tax-free.

Various other costs connected with estate preparation consist of the preparation of a will, which can be as low as a few hundred bucks if you make use of among the ideal online will certainly makers. There are specific files you'll need as part of the estate preparation procedure - Estate Planning Attorney. Several of one of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth people. Estate intending makes it easier for people to identify their desires before and after they die.

The Best Guide To Estate Planning Attorney

You must start preparing for your estate as quickly as you have any measurable asset base. It's an ongoing procedure: as life progresses, your estate strategy ought to shift to match your conditions, in line with your brand-new goals. And maintain it. Refraining from doing your estate preparation can trigger unnecessary monetary burdens to enjoyed ones.

Estate planning is often considered a device for the wealthy. Yet that isn't the case. It can be a beneficial way for you to take care of your properties and liabilities before and after you pass away. Estate preparation is also an excellent way for you to lay out prepare for the treatment of your small children and animals and to detail your yearn for your funeral and preferred charities.

Applications need to be. Eligible candidates who pass the exam will certainly be formally accredited in August. If you're qualified to sit for the test from a previous application, you may submit the short application. According to the policies, no certification will last for a duration longer than 5 years. Learn when your recertification application schedules.

Report this page